With key Indian benchmark indices, the 30-stock BSE Sensex and the 50-stock S&P CNX Nifty, moving like a swing over a broad range, some interesting questions emerge. Will Sensex touch 20,000 again in 2008? Will the volatility in the markets abate? Would the cost of imported commodities, such as crude oil, play a key factor in earnings growth and in turn on the value of index? Before attempting to answer these questions, let me give you a prelude on why the markets are where they are.

With key Indian benchmark indices, the 30-stock BSE Sensex and the 50-stock S&P CNX Nifty, moving like a swing over a broad range, some interesting questions emerge. Will Sensex touch 20,000 again in 2008? Will the volatility in the markets abate? Would the cost of imported commodities, such as crude oil, play a key factor in earnings growth and in turn on the value of index? Before attempting to answer these questions, let me give you a prelude on why the markets are where they are. Markets were over-valued in January

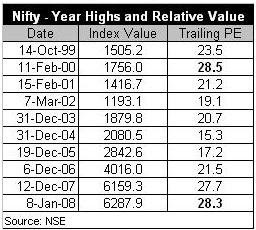

During January this year, when Sensex scaled its life time peak of 21,206, it was valued at a whopping (PE) 26; Nifty was valued at about 28. In contrast, several leading emerging market indices were priced relatively lower (PE of 15 to 20) during the same time frame, an indication that Indian markets were relatively over-valued. Comparing the value of index with prior period peaks (see table) also indicated that our markets were relatively over valued in January. In the last nine years, Nifty was priced at its peak value of 28 only twice - in February 2000 and in January 2008; index witnessed a sharp nosedive subsequent to these peak periods. PE values were lower during all the other Index peaks.

Corporate

A surge in the PE multiple was not only because investors valued the market higher, but also due to the steady deceleration of earnings growth of Corporate India over the last three quarters. An article, recently published by one of the leading financial news dailies The Hindu Business Line, which had analyzed the March quarter results of 800 companies also substantiates this trend; Revenue, on an average, grew at about 21%, while profit after taxes grew at about 17% respectively. In comparison, growth in revenue and profits in the year-ago period were at 30% and 35% respectively.

Key FIIs walked away

Driven by a sharp reduction in the interest rates by the Federal Reserve, starting September, Foreign Institutional Investors (FIIs) made a net investment of $17 billion (about Rs 71,000 crores) in Indian equity markets during last year. In contrast, FIIs had invested only about $8 billion in 2006. However, in January, in the wake of higher valuation and a steady decline in earnings growth, key FIIs sold a sizeable portion of their investment and walked away triggering a sharp correction in the markets. Subsequently, the markets have managed to stage a recovery but have managed to remain volatile over a broad range. FIIs, though continue to buy Indian stocks, have remained net sellers in 2008; FIIs have sold (net) $3.8 billion worth of securities as of 2nd June.

Please read the Part – 2 of my opinion for more.

Madhan Gopalan

The author, who is currently based at

No comments:

Post a Comment